Estate planning is implemented through trust, and each type comes with its benefits. If your client is looking to set up one for themselves, then the best question is what purpose they are trying to solve with it.

But that’s just the question to get the conversation started. Being a reliable and efficient financial advisor entails much more. So, here’s a list of essential questions to ask your client before you decide what kind of Trust is best suited for them.

- Is your primary goal to avoid taxes?

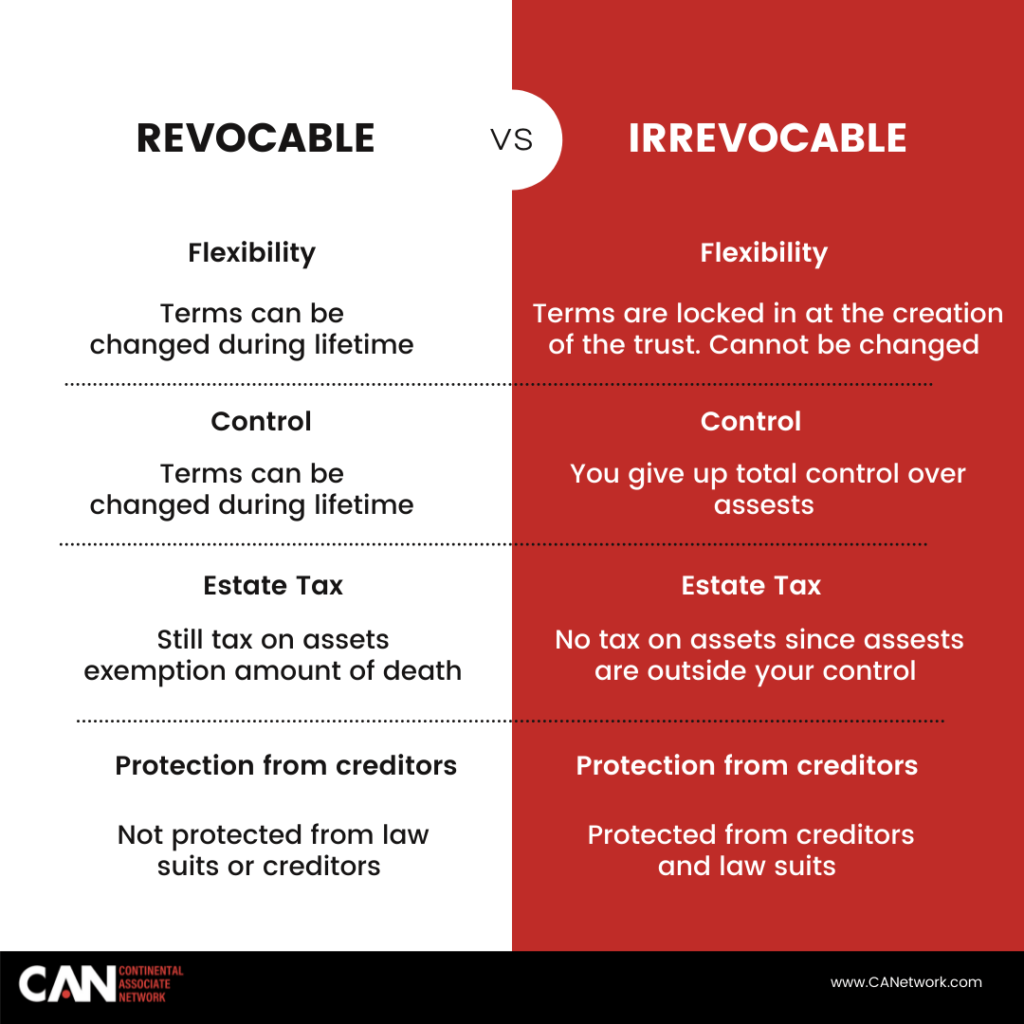

If your client wants to exclude their assets from the private estate, then the best way to do it is to create an irrevocable trust. When you set up a trust like this, the assets that are included are no longer personally owned by your client.

So, in essence, they are not part of their estate. The Trust then has ownership interests instead of your client. However, it is essential to remember that since these trusts are ‘irrevocable,’ they cannot be changed in most cases, establishing to the government that your client no longer has any claim on those assets.

- Are you trying to protect assets from lawsuits and creditors?

In this case, too, an irrevocable trust is recognized as an independent entity by the government and protects your client’s wealth from creditors. Even if their assets in the Trust are distributed to the respective beneficiaries, it remains protected.

You can ask your client to opt for a spendthrift Trust that protects the assets from creditors, allows distribution to beneficiaries, and protects the assets from their beneficiaries’ creditors as well.

- Are you looking to provide for your minors?

As a financial advisor, you can suggest a testamentary trust for your clients looking to protect the interests of minor or disabled beneficiaries. This type restricts access of the beneficiaries until they reach a certain age.

You can pick the age to terminate testamentary Trust, and it will allow your client’s beneficiaries to use their inheritance as they choose.

- Is your goal to provide for your grandchildren?

In that case, you should suggest a generation-skipping Trust to your clients. This type will directly allow them to skip a generation and disburse assets to their grandchildren. There could be many reasons to create this kind of Trust, the foremost being that your client’s children are already doing well and do not need their parent’s inheritance.

Bypassing the next generation also allows their children to avoid paying any estate tax. Additionally, your client can still choose to distribute the Trust’s income to their children while keeping the ownership of the assets for their grandkids.

- Are you looking to set up a charitable legacy?

If a charity is what your clients are looking for, then there are two different options to consider: charitable remainder Trusts and charitable lead Trusts. Charitable remainder trusts pay your personal beneficiaries for a pre-determined number of years, after which the rest of the assets are disbursed to the charitable beneficiaries.

On the other hand, charitable lead trusts are set up to exist for a certain period during which the charitable beneficiaries receive payments from the interests of the principal assets included in the Trust.

- Is your concern linked to the fate of your assets in case you are incapacitated?

The revocable Trust best solves this purpose. It allows your client to name a successor trustee who will manage the assets if they are incapacitated. All stakeholders like banks, transfer agents, and brokers prefer to work with a Trust successor than someone with a simple power of attorney.

This type of Trust is also called a Living Trust, and without it, your client’s family will have to go through lengthy conservatorship proceedings. Having a successor trustee will allow them to disburse assets to their heirs seamlessly.

- Are you looking to diminish your spouse’s control over the Trust?

A Qualified Terminable Interest Property Trust, also known as a QTIP, is perfect for such concerns. They allow your client’s spouse to get the income from it while limiting their access to the principal.

Restrictions can include how the funds are to be used and how much of it can be used. This type also restricts their spouse from making decisions on how to transfer funds, even if they pass away much later than your client. QTIP trusts are perfect for clients who have had more than one spouse or are in complicated relationships.

- Are you looking to build a Trust around your home?

If that is the case, then a qualified personal residence trust is the right option for your client. A QPRT allows your client to put their residence in a contract which will enable them to use the home for a decided period, after which the Trust takes ownership.

However, if your client passes away before the residence is transferred to the Trust or its beneficiaries, it will be considered part of their estate.

- Will life insurance money fund your Trust?

For these situations, an irrevocable insurance trust works best. Your client can have the trustee own their life insurance policy, where they are the insured, and the Trust is the beneficiary. Since it holds the life insurance, it will not be considered part of their estate.

When your client passes away, the trustee collects the insurance and disburses it among beneficiaries after paying off the remaining debt or taxes.

These nine questions will help your clients figure out which is the right Trust for them. If you want more such solutions and globally accepted bespoke life insurance and legacy planning options, get in touch with Continental Associate Network today! We are all you need to offer the best services to your HNI clients and grow your advisory business.