Insurance protects clients from unforgiving circumstances, helping them bounce back on their feet, even if times are rough. When it comes to insurance, you hope your customer should never have to use it. Critical illness insurance falls right on top of that list.

What is a Critical Illness Insurance Plan?

Medical emergencies are common in today’s day and age, and it is difficult to foresee when someone is diagnosed with a terminal illness or a sudden catastrophe. Whether it is a cancer diagnosis, a sudden stroke, or a heart attack, things can quickly fall apart in such cases.

If your client has a critical illness plan, it will provide them with the assistance they require during such challenging times. Let’s us see the importance and strategies you can use to pitch critical insurance to your clients:

Why it’s necessary:

As per leading health experts, the risk of critical illnesses increases with time and age, becoming an essential factor.

Here are a few primary reasons behind the importance of critical illness insurance:

- Critical illnesses can happen at any given age.

- Extortionate living and medical costs.

- Even if treated entirely, many such diseases can recur

- Many conditions, such as various sorts of cancer, can be expensive to treat

- Post diagnosis care payments

Strategy to pitch and sell critical illness products

When selling critical illness insurance, one of the most compelling points you can make is that the lump-sum benefit can be used for anything. That can help pay expenses such as transportation costs to and from treatment centers, prescriptions, hotel stays, experimental treatments.

Here’s how you can identify a prospectus to start with:

- High-risk occupations that invalidate them from disability coverage.

- High-deductible health insurance schemes.

- Self-employed folks are usually underinsured.

- Existing clients and prospects who have no coverage for spouses and kids.

How to pitch it to your clients?

As with other insurance products, the first step is to identify your clients’ needs, but a critical illness insurance plan is an extra advantage. It will provide coverage for any person under age 65.

Value addition approach – It is considered best to list out all the advantages for the client, but the value-added approach requires that benefits be paired with the answer to “How does it help you?”

This will give clients a solid reason why they need to invest in the product and safeguard themselves and their families in case of adversities.

Personalized approach – Creating a personalized presentation helps build upon the trust factor, which is crucial in this industry where statistics are abysmal.

Objections or concerns – These are typically seen as obstacles, but they can actually prove advantageous. When preparing your pitch, address concerns independently.

Six Questions to ask clients that will identify their needs

Many advisors say that the question and answer approach effectively introduces the risk of a critical illness and the solution of Critical Illness coverage. You can help your clients understand the need for critical illness coverage by asking the following four questions:

- Do you know someone who has been diagnosed with cancer, heart attack, or stroke?

- Did this diagnosis come as a surprise?

- Was it tough emotionally or financially for them, their family, or their business?

- If someone had walked in and said, “Here’s some cash. You can use it however you think best to get through this,” would that have helped?

- How much money would you need to cover your expenses for three months?

- How would you pay the bills for expenses in the event of a heart attack, stroke, or other condition?

Common objections you may hear from your clients.

Objection 1 – “It’s too expensive.”

Critical illness insurance is pricier than term life insurance because it’s more likely to be used. (Each year, 14 percent of people who have term-life policies let their policies lapse, according to the Life Insurance and Market Research Association

Objection 2 – “I’m healthy; I don’t need it.”

When you’re healthy is the right time to get critical insurance before it’s delayed. We don’t plan on purchasing a critical illness and never know when it may strike. Because you’re fit, there’s a good reason you would be in a more favorable position to endure disease and have to pay the costs that go along with it.

Objection 3 – “If it’s important, why haven’t I heard about it before?”

Critical illness insurance has been available for about 30 years. Prior generations didn’t need it because fewer people survived a heart attack, cancer, or stroke diagnosis. With advances in medicine, more people live after a heart attack, cancer, or stroke diagnosis.

Objection 4 – “I’m not ready yet.”

If your health changes, you could lose eligibility for the plan. If the health of a close family member changes, that could change your family’s eligibility, too. Also, the younger you are when you buy the policy, the lower your premiums will be.

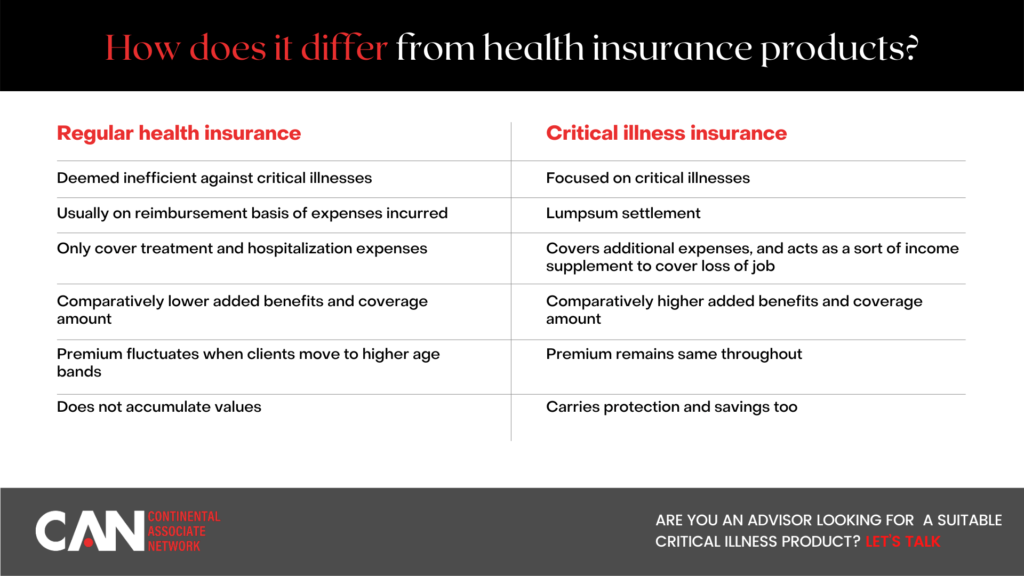

Object 5 – “I have health insurance.”

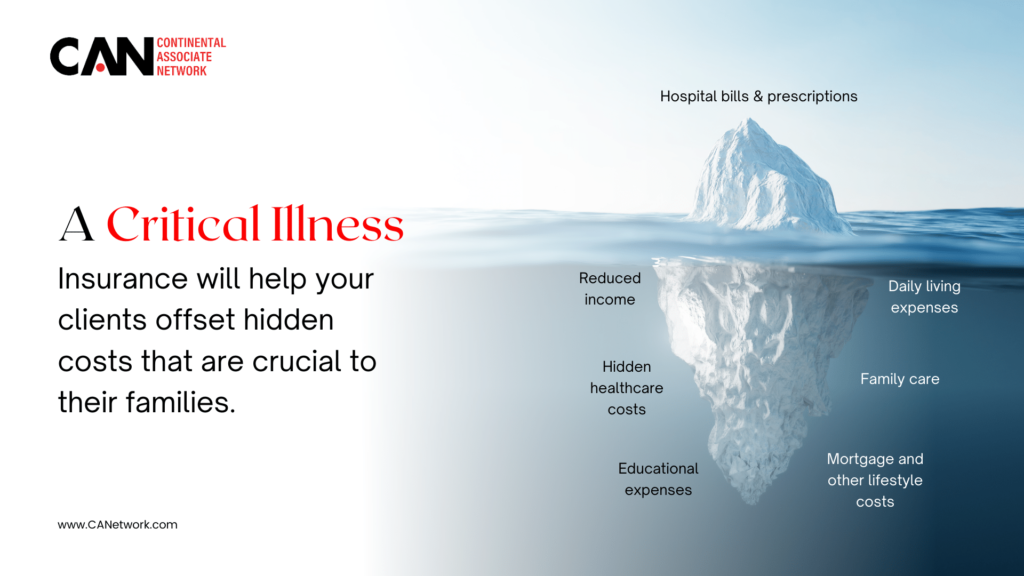

Yes, you are covered by health insurance—but what if you or your family had to cover your lifestyle costs during an extended hospitalization?

You might not have considered the impact a severe illness or accident could have on your/your family’s finances. A Critical Illness Insurance policy can help you cover hidden costs like Reduced income, daily living expenses, hidden healthcare costs, family care, mortgage.

How can CANetwork Help You?

Get in touch with your clients today and discuss critical insurance plans with them. If you are looking for high-value bespoke insurance plans covered in multiple geographies, then contact CAN. We can help you connect with high-net-worth clients and give you the tools you need to grow your insurance business.

Schedule a one-on-one consultation with us, and we can help you offer nothing but the best bespoke Critical Illness solutions for your HNW and UHNW clients.