HNIs have similarities in the methods of investing money, but oversimplifying all the investment venues to be the same, is peculiar. Ultra HNIs is a diverse group of people, sharing different business ventures. From a business with long old roots to new-gen entrepreneurs, each and every investment choice differs with the choice of business.

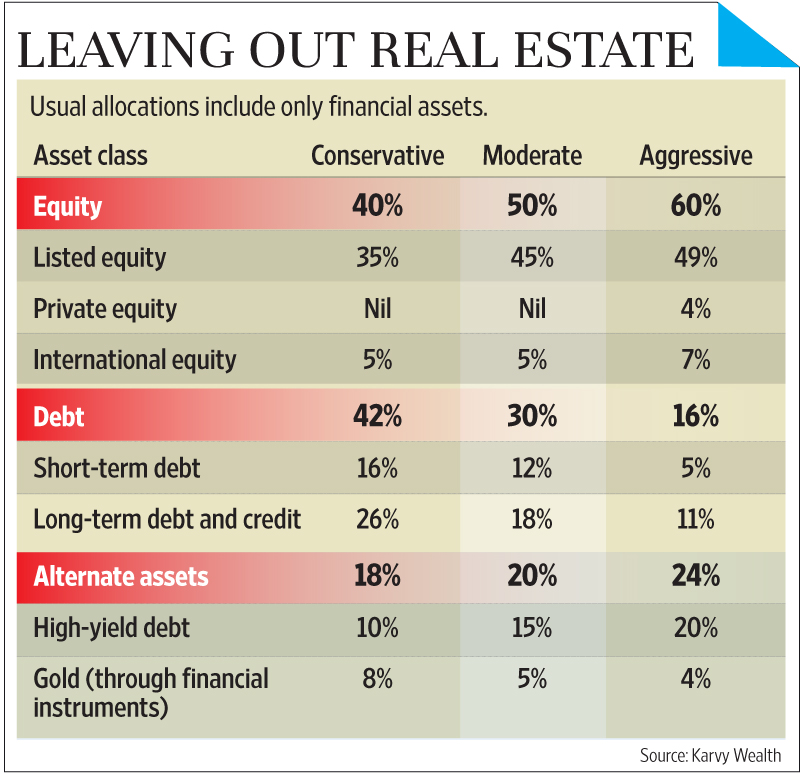

The shifts in the economic and market cycles also decide the shift in preferences for investments. Before high-value life insurance and financial assets came to the bigger picture, HNIs and Ultra HNIs preferred investing in real estate, because of the lack of returns from the particular asset class and also its under-performance. Real Estates needed a strong administration and a worthy successor to maintain the large solid asset. But with the emergence of shifts in economic cycles, the investors have started opting for financial assets like high-value life insurance. It does not need a strong administrator or a successor to look after it, and it very much suits the needs of current HNIs and Ultra HNIs.

Well, with a shift in the economic cycle and continuation in variation in prices, there might be a chance for some components of Real Estate to become interesting investment options, such as equity investment in housing finance companies, reputed real estate companies. Investors can enter into this financial asset class with the help of REITs.

Family Offices can develop a positive legacy and support long-term wealth preservation along with developing positive changes and profits. All achieved only by the means of sustainable investments. This method along with impact investing has caught attention of many investors in recent years and has given an impressive rise to rate of investments.

Impact investing — investing with the intention to generate significant observable environmental or social impact, while providing a competitive financial return. Impacting Investing tends to grow, with an increase in interests of investors around the world. Agriculture, education, and energy and resource efficiency are the most common areas of investment.