Market volatility is a reality that no investment policy can avoid. As a financial adviser who is set to help his/ her HNW and UHNW clients, you have to help them understand why this happens and how to make the most of it. We understand Discussing Market Volatility with Clients can be tricky and sensitive for some people, but unless you can help them find comfort and conviction in their investments, there will always be a chance that they give into their panic before returns reach their fruition.

In this blog, we will discuss how you can help your clients deal with such situations and trust you to ensure maximum growth of their assets.

Let’s find out the right things to tell your clients regarding market volatility.

Putting things in perspective

The first and foremost argument to help understand market volatility is to accept it as an integral behavior of a healthy market. When you consider in hindsight, the market has always recovered from the worst crashes, like the Great Recession.

However, the only way to survive is to hold their impulses and let things run their course. Moving into a panicked state will prove counterproductive later, and this should always be your clear first advice to high net-worth clients.

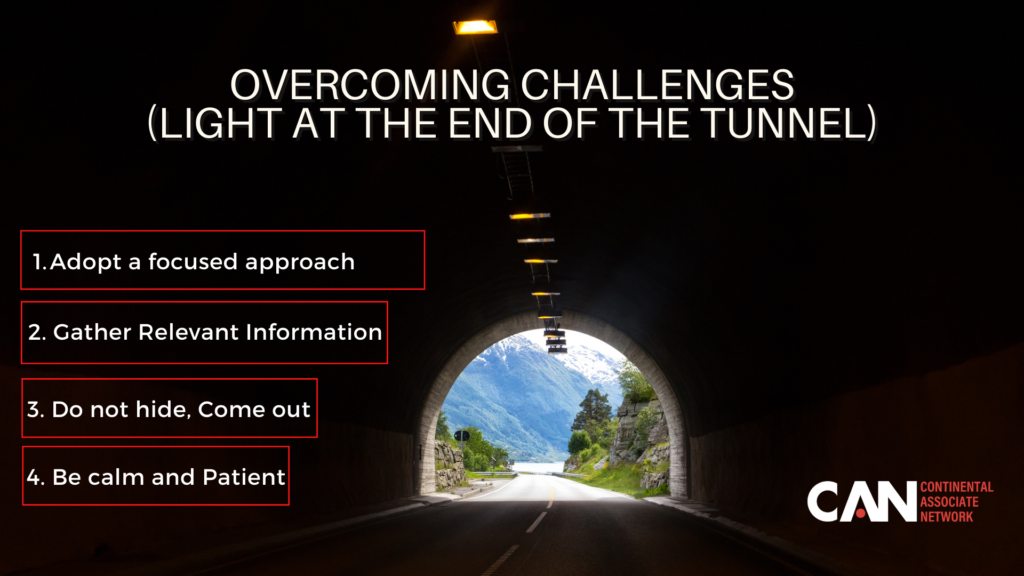

Address tunnel vision

Often our anxieties get the best of us, especially if there are thousands of dollars in investments at stake. However, it would be best to remind your clients that while things might seem a little off now, it does not necessarily mean we have been diverted from our goals.

A good metaphor for this is the panic all drivers experience in heavy traffic because they cannot focus on their primary goal to reach on time. In this case, your job is much like the GPS, reminding them that they are still on schedule and will be able to reach comfortably. Reassuring clients is something all financial advisors must practice and implicate while

A good metaphor for this is the panic all drivers experience in heavy traffic because they cannot focus on their primary goal to reach on time. In this case, your job is much like the GPS, reminding them that they are still on schedule and will be able to reach comfortably. Reassuring clients is something all financial advisors must practice and implicate while discussing market volatility

Educate them

All fears and anxieties either stem from misinformation or the lack of information. So, if you are dealing with a client who has entirely shifted into panic mode, maybe it is time to educate them.

While discussing market volatility,explain how their investments are still on track to reach the goals you had discussed and explain the various performance metrics based on making the assumption. Also, try the Monte Carlo analysis and its randomized market scenarios to paint a better picture of long-term stability for your clients. Once their fears are addressed, a volatile market and will not throw them off as much.

Goal funding analysis

People invest to achieve their personal and financial goals. With a well-planned goal funding analysis, you will be able to show your clients that despite market fluctuations, they are still very much on track as far as reaching their goals are concerned.

And in case the projections do seem off, you can always take corrective actions to ensure that you end up as close to the finish line as possible at the end of it.

Use end of analysis metrics

This method is highly effective for planning their retirement or legacy. With the use of end-of-analysis metrics, you can help them find out how their investment plans are working out and if there are any chances of it not performing as well as they should.

In this case, too, advisors can use corrective investment measures to reroute the plan if it seems to miss the magic number. The trick is to sit your client down and help them understand how the current market will/ unlikely to impact their investments!

Help them model their decisions.

One mistake that many HNW and UHNW investors make is liquidating their assets when the market turns volatile. This is the worst possible way to handle a financial crisis.

As their wealth advisor, you can help them prioritize when such impulses take over. Rather than advising them to pull their money out of the economy, ask them to prioritize financial goals that matter more.

This way, when the market goes back into recovery mode, your most important priorities will stand to gain from the decision modeling exercises you did with your client earlier.

Always stay invested

Remember, the market is a representation of the mindset of its investors. If everyone is feeling optimistic, then the market will recover fast, and if everyone is in a panic mode, it will lose a lot of money.

Whenever the market is stricken with unforeseen circumstances, the best way to tackle the situation is to stay invested. While it might seem to your clients that they are losing money, in the long run, it will recover and, more likely than not, give precisely the returns you had promised them.

However, if they pull their money out, they will not even recover the capital in some cases.

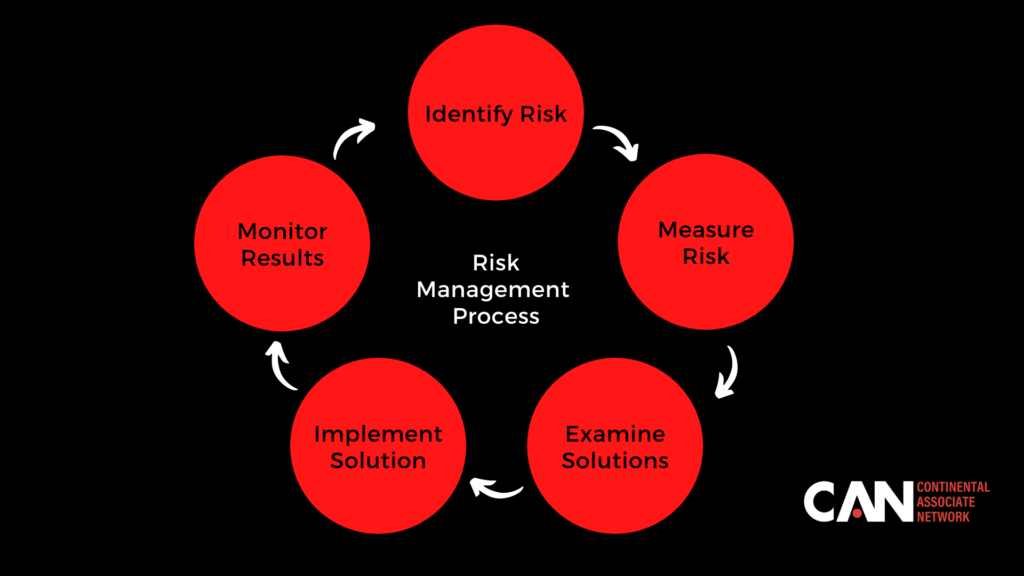

Take an active approach to risk management.

Every financial advisor must understand that the risk tolerance of all investors may not be the same. Therefore, you must make sure that you take preventive measures to ensure that it isn’t by a lot, even if you miss your client’s financial goals.

Hedging or buying new assets at low prices during market downturns could help you recover a lot faster once things start moving back to normal again!

Follow our eight-pointers while discussing market volatility with your clients, and it will become much easier to explain without moving into panic mode. Also, if you are looking for low-risk and high-return investment solutions like life insurance, estate planning, and legacy solutions, then we are here to help you with it.

Get in touch with us at Continental Associate Network, and we will help you find tailor-made investment solutions for your HNW and UHNW clients, no matter how the market is performing. Book a free one-on-one consultation with us today.