Founded in 1927, The MDRT is a premier association of financial professionals, and there are advisors worldwide who strive to Qualify for MDRT. Any financial adviser worth their salt knows what it means to be a part of the prestigious Million Dollar Roundtable. The prestigious group is a professional club of wealth managers and insurance professionals driven to make a difference for their clients.

Their network makes them the crème de la creme of the business. So, no matter how you want to grow as an adviser, insurance, to qualify for MDRT and getting a seat at the big table is going to open doors for you.

But here are the million-dollar questions:

- What’s the eligibility?

- How do you get in?

- What are the benefits?

Thanks to us, we will cover all your queries and help you qualify for MDRT and get a seat on the table that matters! Here are million-dollar round table requirements:

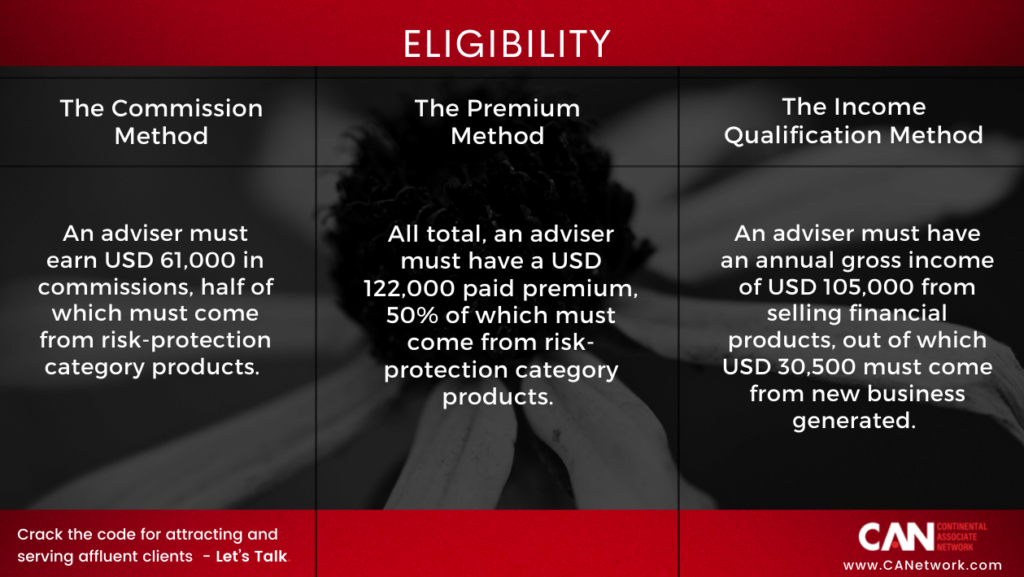

What’s the eligibility?

Simply put, there are three standard ways in Million Dollar Round Table Requirements that financial advisers can follow to become a member.

The Commission Method

An adviser must earn USD 61,000 in commissions, half of which must come from risk-protection category products.

The Premium Method

All total, an adviser must have a USD 122,000 paid premium, 50% of which must come from risk-protection category products.

The Income Qualification Method

An adviser must have an annual gross income of USD 105,000 from selling financial products, out of which USD 30,500 must come from new business generated.

There are a few changes made in the eligibility rules for the current year due to the ongoing pandemic. But in gist, if you have any of these parameters reached, you too can become a member.

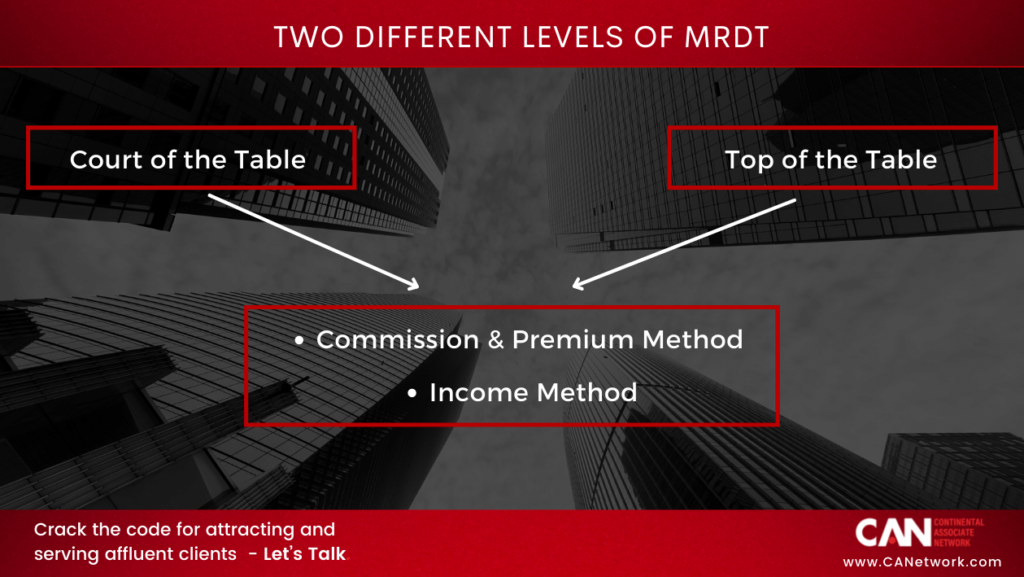

However, MDRT has two different levels.

However MDRT has 2 different levels.:

Court of the Table

Commission & Premium Method

A minimum of USD 183,000 of eligible commissions paid or USD 366,000 of eligible paid premium is required. At least USD 30,500 of commission or USD 61,000 of premium (50 percent of the entry-level MDRT requirement) must come from products listed in the Risk-Protection category before applicants can use any credit from policies listed under the Other Products category.

Income Method

A minimum of USD 315,000 of eligible annual gross income is required. The applicant must meet the minimums of USD 30,500 in new business and USD 30,500 in the risk-protection industry.

Top of the Table

Commission & Premium Method

A financial adviser must make a minimum of USD 366,000 of eligible commissions paid or USD 732,000 of eligible paid premium. At least USD 30,500 of commission or USD 61,000 of premium (50 percent of the entry-level MDRT requirement) must come from products listed in the Risk-Protection category before applicants can use any credit from policies listed under the Other Products category.

Income Method

A minimum of USD 630,000 of eligible annual gross income is required. The applicant must meet the minimums of USD 30,500 in new business and USD 30,500 in the risk-protection industry.

Now that all the little details are covered, let’s get into how you can score a membership.

Just make a high-value life insurance sale with Continental Associate Network, and we will ensure you find your place on it!

Also Read: 10 Strategies to Attract, Engage, and Land High-Net-Worth Clients

However, if you are unsure how easy our offer is, then here’s a list of benefits to help you make your mind up on this coveted membership.

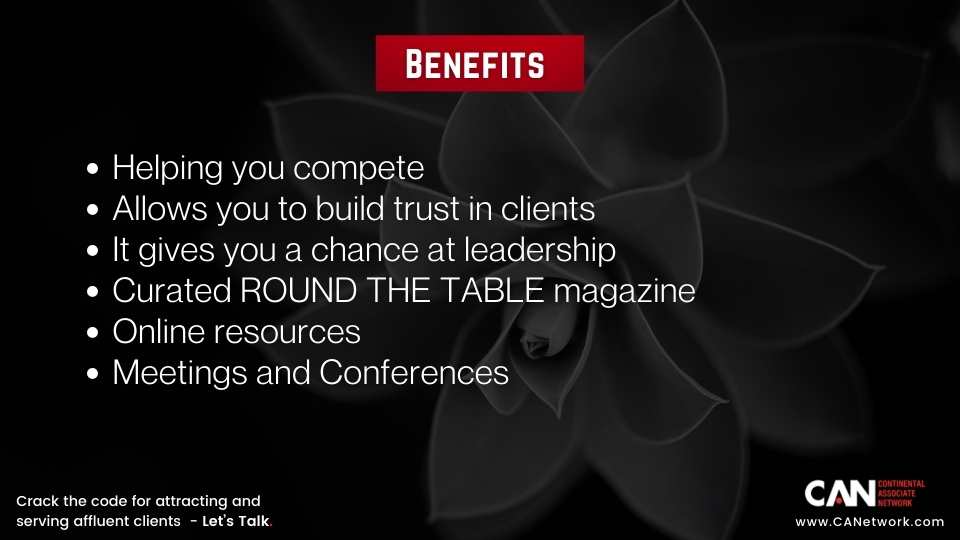

Benefits of being an MDRT member

The organization has been helping financial advisers grow with like-minded people since 1927. Here’s why you should want to be a member of a 94-years-old club:

Helping you compete

The insurance and financial adviser market is highly competitive and often subjected to objections and regulatory changes. At MDRT, professionals get a chance to learn industry best practices and learn from some of the most accomplished in the field.

Allows you to build trust in clients

When a high net-worth insurance agent or financial adviser has an MDRT membership in their pocket, building trust with high-value clients is just routine.

It gives you a chance at leadership

Imagine having the opportunity to lead a prestigious financial organization with a rich history and global diversity! That’s what you get to pursue at MDRT to grow your business even further.

Curated ROUND THE TABLE magazine

The bi-monthly magazine gives you information on the latest trends and news, helping you and your business grow.

Online resources

There are several online resources available to the members of the organization. These online resources can help you learn more about high net-worth insurance and how to sell better.

Meetings and Conferences

Members can attend meetings and conferences with the top insurance and financial advisers. It solidifies your networking, allows you to learn from the best, and makes the industry’s top tiers more accessible to you, and eventually helps you make those high-value life insurance sale

Now that we have answered all your questions on how to qualify for MDRT MDRT and why you should become a member, what’s next?

Learn how Continental Associate Network can sponsor your mebership of Million Dollar Round Table (MDRT). Book a call to know more about it.

Get in touch with us at CAN and book a free one-on-one consultation that will help you dominate the HNW insurance space!