Things to know about HNI

India is one of the major developing hives for HNIs (high net-worth individuals); every year, there is a rise in HNIs capitalizing and residing in this vivid country. And it is expected that the number of HNIs present will surge by136% by 2025, reaching up to 5.54 lakhs. For you to stay up to date, we want to share our knowledge about Things to know about HNI.

Opening a vast market for financial advisors for making a profit out of HNIs rich portfolios.

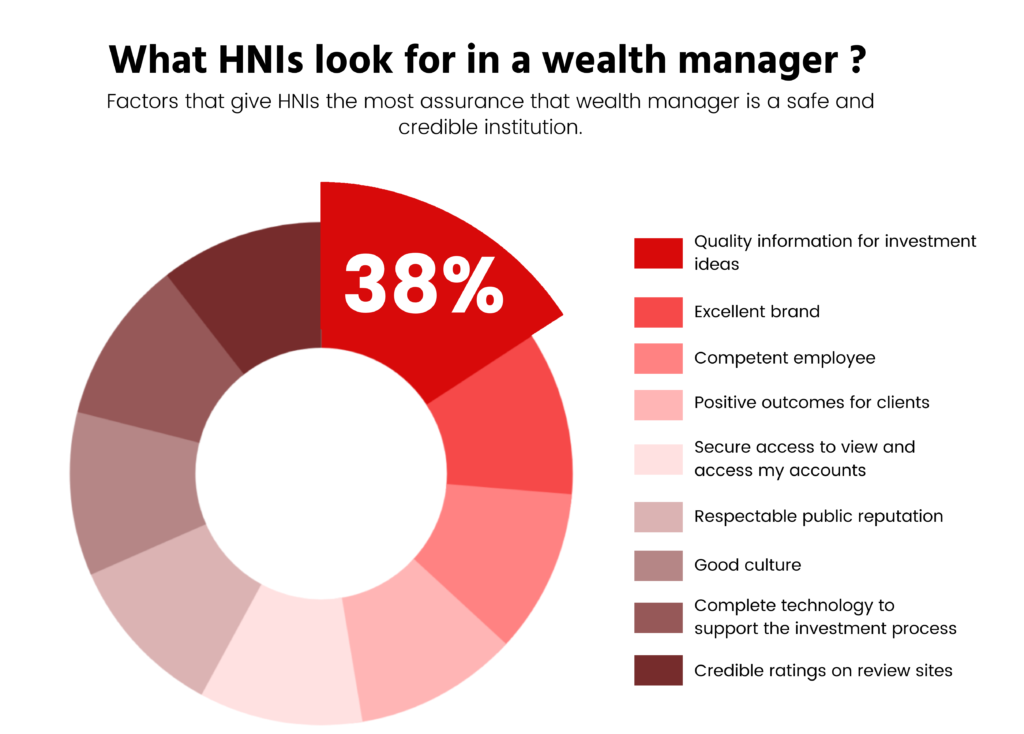

But the opportunities open in the market are minimal, as the HNIs don’t look forward to financial advice regarding fulfillment of regular needs and luxuries because they have already attained all of their goals through their current reach. An HNI looks for advisory, which will help him effortlessly expand his financial reach. He expects financial advice to be tailor-made according to his specifications. Making the tempting opportunity a little more challenging.

To conduct neat business with HNI clients, a financial advisor needs to

understand their client first. They need to understand their behavior towards investments, their economic goals, and their manner of dealing with people, etc.

The advisor needs to explain to his HNI client that his achievement in business and his competent marketing may be somewhat worthless in investments. It may be difficult to convince the successful HNIs that their success in personal life can’t be carried forward to the investment strategy. However, financial advisors need to steer the investment wagon themselves. Being the expert, they need to show and apply their possessed expertise to benefit the client’s portfolio.

The first advice given to the HNI should be -‘ to form a will’, and take the client

through a will writing process. Without a will, lots of HNIs in India have suffered in making their business survive in the market. A will left behind after the demise of HNI will leave a secure business survival plan for his successor to work on. HNI needs to be convinced for forming a will, to avoid unrest in his family after he passes away

Secondly, an advisor needs to diversify HNIs portfolio by influencing them to invest in liquid assets, mutual funds, financial assets like high-value life insurance other than blindly investing in real estate. HNIs invest a lot in real estate without examining the drawbacks of such investment. With the shift in the economic cycle, there is a need for them to understand the negations while investing in real estate.

Advisors need also be certain about their client’s relationship with their bank

relationship managers. In many cases, it has been observed that these managers influence HNIs a lot and push them to invest in down-fitting plans. The banks suggest investment products opposite to their portfolios. An advisor needs to steer clear of anything that brings down his client’s portfolio.

As an advisor, it is best to avoid tricks played by the HNI clients, while they take away the standard expense ratio of transactions. Being successful businessmen, they opt for their benefit in every scenario and while extracting the standard expense ratio in every transaction, they tend to reduce it. An advisor must not fall into their bargaining traps and should not commit to their terms of investment, because it will only cause loss for the individual. To benefit oneself out of this situation, it is best to add value to the terms and focus on advising with the flow of the problems, the investor is facing. It will make the relationship between the advisor and client stronger.

HNIs should safeguard the reserves of their wealth. They ought to secure their wealth by attending investment options that will safeguard their wealth with higher returns than inflation rates. In reality, the HNI seeks financial advisors to safeguard their financial growth. They don’t just desire economic stability. They wish to generate more wealth and are ready for the risks of the market. All sought and done with the help of a trustworthy financial advisor. HNIs lack diligence when it comes to achieving their own goals. Involved in their business, they don’t discuss much with their advisors. But totally rely on advisors to be updated with every turn of the economic cycle and technological advancement.

This puts the advisor in the driver’s position and very much responsible for anything and everything happening to the client’s portfolio.

To devise a strategy for investments and alterations in portfolio, advisors need to consult their clients. But HNIs are too much involved in their business, and cannot give time to consult with the advisor. Later, leading to failed or delayed investment decisions.

Also Read: Understanding how to handleHNI Clients

Advisors must respond to the emails or calls of their clients immediately. The query must be acknowledged even if solutions aren’t available at the moment. Being an advisor, there should be an effective and efficient communication system while dealing with HNIs. According to a recent study done by Spectrum Group, “more than one-quarter of millionaire and one-third of UHNW (Ultra High Net Worth) respondents say that they want a response to a phone call in two hours or less.

But advising HNIs who have reached their old age, or are in their late 60s or early 70s, can be very different. It’s like a challenge, as senior citizens among HNIs earn enough wealth to maintain their luxuries and needs. In most cases, they share the goal of leaving a huge estate for their successors, so they need to be approached differently while discussing investments. These clients possess many opportunities with them, they can easily be interested in an equity plan that grows fat returns in a span of decades. To lure these HNIs, advisors must arm themselves with unique investment strategies.

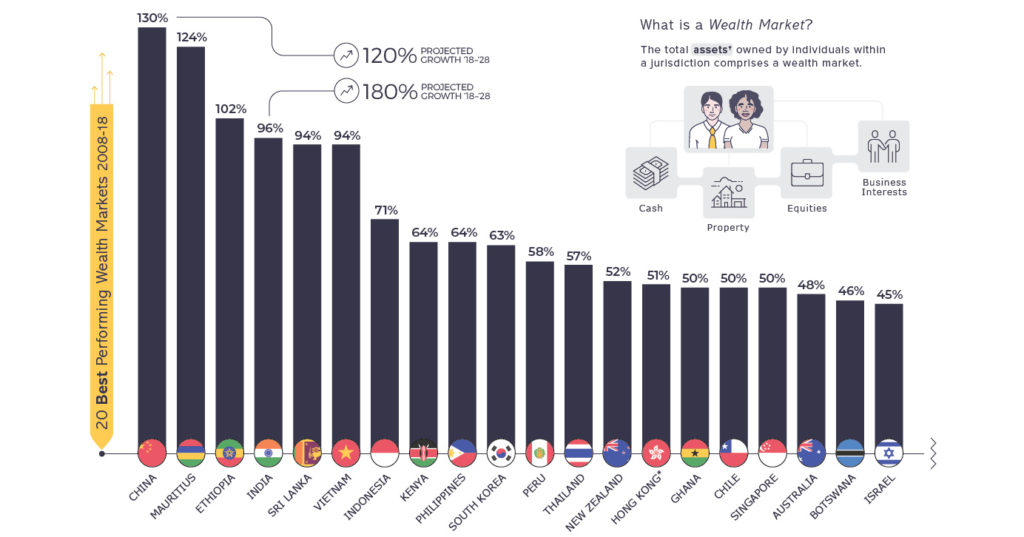

If you are a Financial Advisor and seek to advise HNIs, keep all these attributes discussed above, close to your mind. Keep updating with the world, the global market keeps cycling through, economy slows down, currencies fall, and some markets surprisingly observe a surge. Be updated about everything, sometimes you may even need to learn about the interests about a prospect.

Focus on marketing yourself, concentrate on small things, like logos, websites, etc. Mind all the things that an HNI will point out while searching for an advisor to trust. Communicate effectively with clients, never narrow your spectrum, always speak openly and confidently. Be bold about the contract you would like to share with the client and brief them about the amount of work you will put in to bring him the desired result.

Continental Associate Network (CAN) provides access to best-in-class financial solutions and access to an exclusive list of prospects. Partner with CAN today and get benefited from bespoke solutions tailored for High Net Worth Clients and Unapparelled guidance at every stage. To learn more, book a free one-on-one consultation with us.