Today’s youth holds the potential of being successful at investment advisory services. Nonetheless, the mentality of people to gain secure jobs and a stable salary has stopped their expanse of thinking, and the youngsters never get to know the possibilities of being a successful financial advisor. They are unaware of one of the fastest-growing professions across the world. To be a successful investment advisor, a lot is required among a person such as a convincing personality, positive attitude problem, solving skills, analytical abilities, knowledge of legislation. And these can be easily developed by just acquiring some simple habits. We have shortlisted such 9 Habits of a Successful Financial Advisor, that every advisor must know.

It’s better to learn from the financial advisors who have already achieved success. It’s a good step in acquiring some of the habits they have, and to develop them within oneself. Here are some habits on how to be a successful financial advisor, read through:

1. Getting up, close, and personal

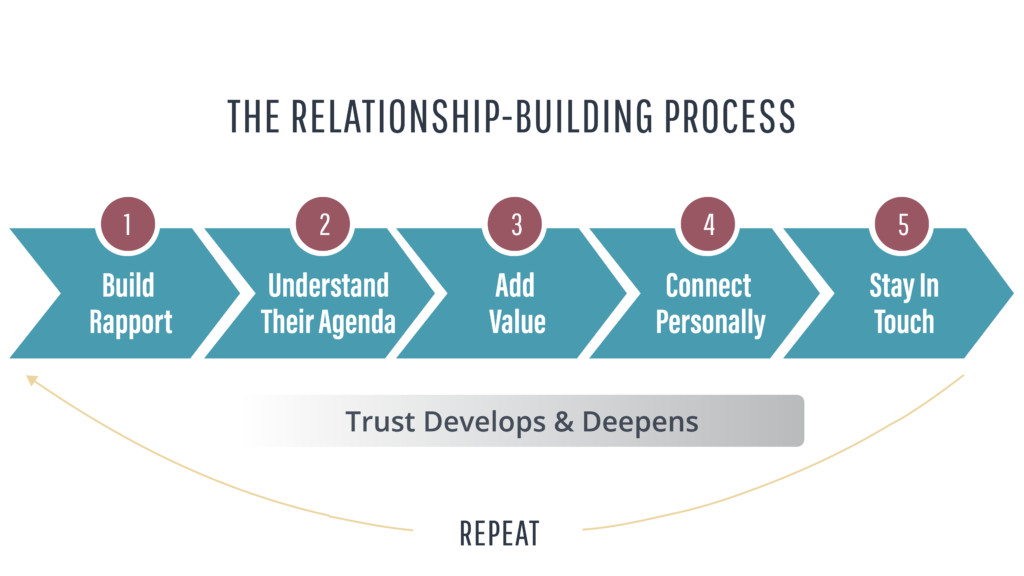

When it comes to building a relationship with the client, emails, and letters following them will not attract their attention. The best way to develop their interest is to approach them personally. Since the advisory services are all about building trust and personal connections, you should help the clients to understand the motivations, values and the interest in the business. This is one very important Habit of a Successful Financial Advisor that develops a grasp over your client, the relationship between you and your client must grow above the clientele. With an emotional connection in the growing relationship, the client will offer their trust more often and easily.

Build up courage, and learn to approach people closely in their comfort quarters.

2. Implementing technology

The world changes, and it has been changing rapidly ever since. With the emergence of mobile technologies and the shift in the tech world, the economic world has graded itself differently. The expectations of the clients have grown anxious with the advisor’s competency rather than the portfolio performance. The clients demand competent advisors who can bear through the updating technologies while incrementing their portfolio. To sustain the luxury to continue advising such clients, you need to enhance your tech knowledge. Seniors advisors, gain and implement this information to keep thriving in the financial advisory business.

A customer relationship management (CRM) software can play a major role in developing advisor-client relationship. It will help in managing all the financial details of clients, while you focus on approaching new clients. CRM can keep a track of marketing programs and closely observe the prospects, helping you to record everything about your clients.

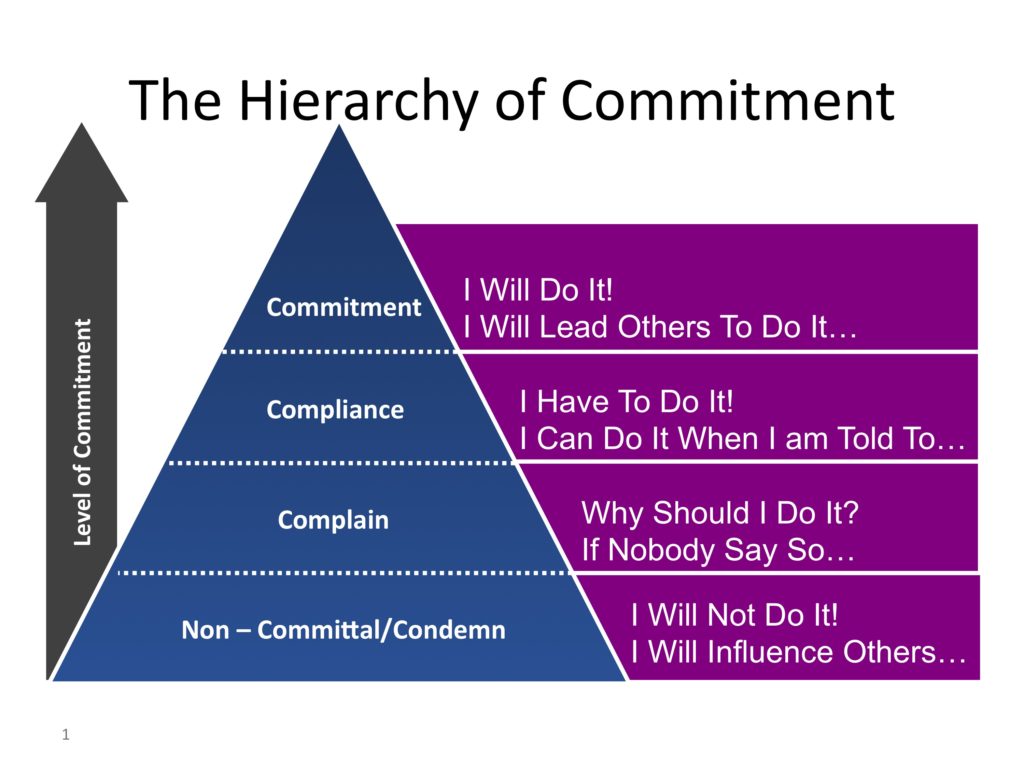

3. Commitment

Habits of every Successful Financial Advisor includes full commitment towards the client. advisors understand the client’s business and ensure them tailor-made services according to their needs. You need to understand that in the business world, your advice should help the client’s portfolio in a way the client needs it. The strategy that you present should meet the demands of the firm. It must align with the problems faced by the clients.

A habit to commit to your client needs to be developed. For a financial advisor, it’s important to develop a strategy for the HNIs, to lift their portfolio forward while catering to their needs.

4. Creating a solid professional network

The biggest investment that you, as a financial advisor, can offer to your client other than advice is your time. Invest time on the relationship shared between you and your client, to make it stronger. Grow the relationship beyond advices, business and co-referral agreements; and develop an emotive trust inside them. Understand each other better to enhance the value of yourself and your advices. It will help you to construct a profitable client-advisor relationship. Experienced advisors and firms benefit themselves financially out of their firm alliance with accountants, attorneys and other HNIs.

Here are some interesting and undeniably surprising methods among established advisors to forge a strong network.

Ditch investment pitches:

Avoid old school methods of opting sales pitch, for building relation. Established advisors often get more personal with clients; by welcoming them into their personal quarters for dinners. Often sharing their personal views by inviting them to seminars.

Organize events of client interest:

Lead into the interest of the prospective HNI. Advisors need to play along with their interest, it has been observed that it makes the client more loyal towards the financial advices. Of all the other methods, if the advisors firmly grips the interest of their client, it will help the most to build a robust bond among them.

5. Having a written vision

Set your goals, and note them down. Having a written vision will motivate you to push yourself every day. It will help you realize the opportunities and challenges lying ahead of you. This habit is prevalent out of all Habits of a Successful Financial Advisor that you may have heard before, but now is the time to practically make this your habit.

Introspect and question yourself, about the goals you have written. If you believe the goal is too big, you may easily break it down into smaller, simpler steps.

6. Proper expertise

Habits of a Successful Financial Advisor is to deliver personalized advice to the clients, advisors must acquire the expertise along with knowledge beyond general affairs. Clients wish for advisors who will guide them to their business goals with ease and simplicity. For a financial advisor, to be updated with the global markets, tech-world, and everything else is very important in financial planning. It is a step forward for you to gain financial wisdom.

7. Be a Guide

To be a successful advisor, it is a necessity and a duty of you to uplift your client’s portfolio. You must become a guide for the HNIs, instead of mere advice, to make them understand the reason behind every investment. Develop a discipline among your client for the economic assets he owns. And in times of economic distress, stand beside your clients to help them in times of market volatility.

8. Vulnerability

Financial Advisors are nothing less than superheroes, but we all are not invulnerable. Even experienced successful advisors are vulnerable. They all have grown up to success with a lot of failure in past. None of them are immune to all the challenges of the market. Advisors who accept their mistakes can gain the confidence and faith of HNIs and the people around them. You should spend time in personal growth and introspection, it will help you to become stronger even in the worst situations. Financial advisors are not immune to all challenges, but they need to have the courage to keep up a fight.

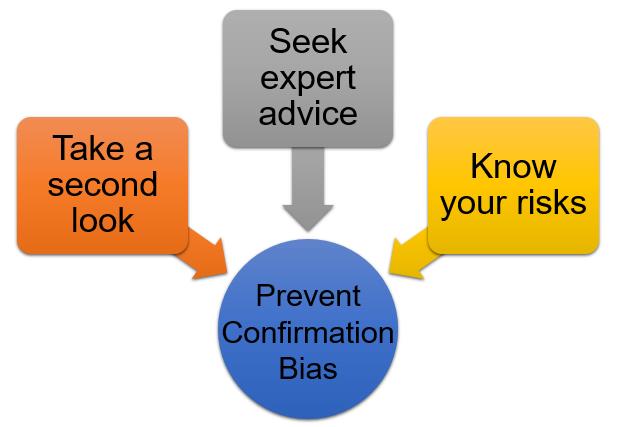

9. Seeking expert advice

Developing habits can be difficult, and so is chasing success. To be a successful advisor, you need to understand the importance of advices and guidance. For better grasping of the habits, you should hire a coach or a mentor. Follow their guidance, keep getting fed by their inputs and receive feedback about your performance. Learn to tread the path, experienced people have left behind.

From the goals achieved to the reports of progress, from investment returns to resolving clients concerns everything holds its importance. But building a strong client-advisor relation is the most important of all. Because it secures the first stage of being a successful financial advisor.