In today’s high-net-worth world, succession planning is no less important than having a financial advisor; any advisor worth his/her salt will inform their clients about it. Ensuring how your client’s wealth will pass on after them should be prioritized, and it is probably the best service you can provide to them.

The uncertain reality of the pandemic has ushered the clarion call of getting your client’s finances in order. However, the often missed piece of the puzzle remains, in most cases, succession planning.

Succession planning is anything but one-size-fits-all. It comes with various complexities depending on your client list, such as beneficiaries, assets, etc. The importance of succession planning is irrefutable, especially for HNW individuals. Every financial advisor must facilitate the seamless transition of personal wealth and protect the business interests of their clients.

Financial advisors must take time to plan out the succession of their client’s wealth and how it will be transferred along with their business to beneficiaries. Succession planning will not just benefit your client but their family and employees as well. Defining the plan will help the transfer of wealth be seamless and conducted amicably. It will also allow safeguarding the business legacy while ensuring that dependent family members are also cared for in the long run.

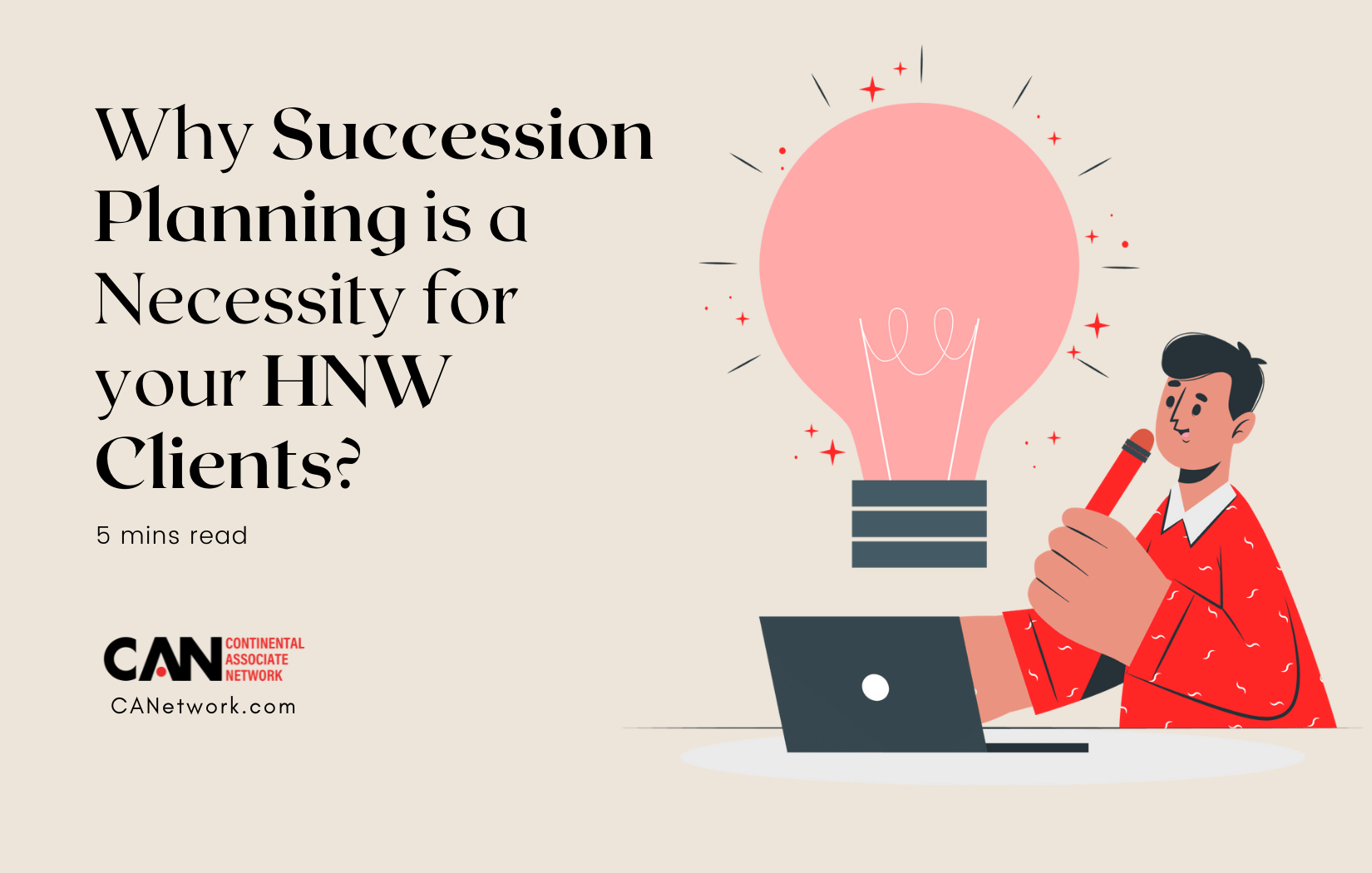

Lately, many HNW clients have been looking to find financial advisors who can help with their succession planning. Today, more families feel the need to have their estate settled and have a plan to minimize conflict and confusion after they pass away.

Also read: 10 Strategies to Attract, Engage, and Land High-Net-Worth Clients

Here is an example to help you understand better and deliver on your client’s expectations:

Consider that Mr. Williams has not planned their succession and does not have a Will or Trust. He had also ignored many of his financial planning obligations for years. Unfortunately, he passed away without caution in 2020.

Since he had not established a Will before his death, now his estate will be divided equally between his two minor children, his wife, and his mother, as is the law. However, his wife will have to jump many hoops and make court visits to ensure that wealth transmission is carried out smoothly, and it can take up to 2 years. She might also have to do more to consolidate the estate and other assets that she might not even know about at all.

Without a Will or Trust, transfer of wealth, even with the simplest assets, can take up to two years, and it could go on for much longer for your HNI clients. Therefore, it is crucial for you as an advisor to convince them by explaining the importance of having a succession plan and transferring wealth without difficulty to the next of kin.

Your HNI clients should not differentiate between their assets and their business assets. Wills are essential, and therefore, every HNI client should ensure that they have one that transfers their wealth according to their wishes.

The absence of a prior Will can significantly extend the transfer of wealth and bring in numerous complications between the family. Some cases also need to have an appointed administrator appointed to monitor the estate during the interim period.

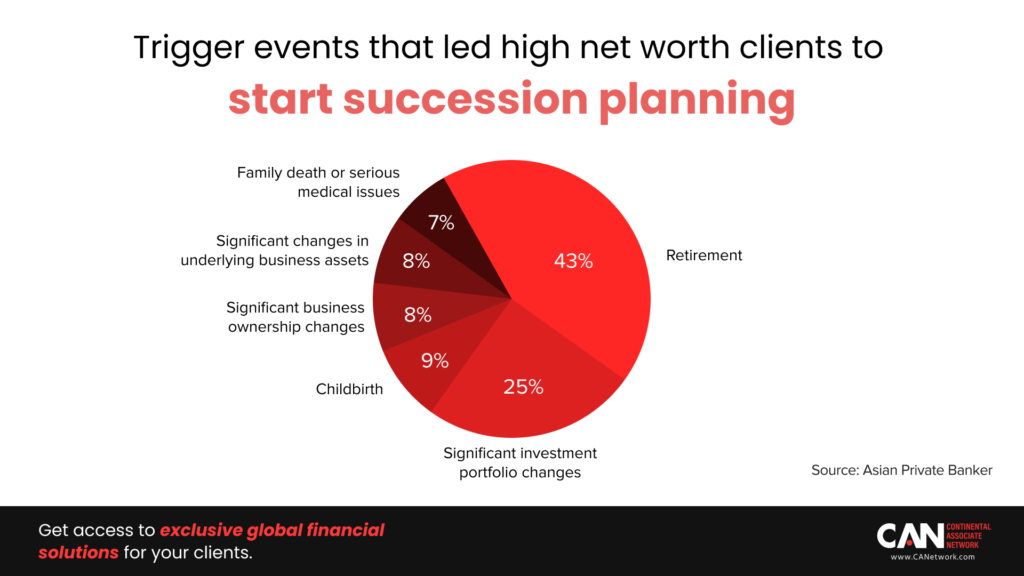

But is succession enough? Is it not the duty of financial advisors to think beyond it and ask tough questions?

If your HNI client answers affirmatively to any of the above questions, then creating Trust is the need of the hour.

While a Will is suitable for primary succession, for HNI clients with a long list of assets, a trust is a much more practical option for holistic planning. Private trusts ensure that:

- The interests of the family are protected.

- Succession plans are carried out seamlessly.

- Assets are protected from any future uncertainties.

- A professional trustee is appointed.

Let’s consider another example:

Mr. Soni started as a first-generation entrepreneur and established a successful promoting business; unfortunately, he passed away suddenly. However, he was the sole decision-maker for all financial and administrative decisions in the company.

Not just that, even the following administrator in charge of his company was reasonably junior. Soni’s children were still in their teens, and his wife did not bother to learn about finances and businesses when he was alive. At this moment of immense personal loss, the future of the company’s management was also not equipped to survive the loss of its leading promoter.

This example clearly illustrates the importance of Trust for HNI clients and business owners, especially if they want to secure the future of their business and its employees. Also, as their financial advisor, you must ask them to train their immediate juniors to take up responsibilities as and when the time comes.

With the proper succession planning, you can help your HNI clients address the needs of:

Globalization, complexity, and recurrent changes in the law have led to a transitional shift in the mindset of HNIs. CANertowork appreciates the need for succession planning, and it counsels and gives access to some premium solutions that can help advisers meet the demand of their HNW Client.